When considering a growth strategy, acquisition strategy, or industry consolidation, private equity (PE) firms must assess the impact on the portfolio company’s brand. Why? Because in any strategic approach—platform play, carve-out, or roll-up—branding plays a crucial yet often overlooked role within the complex landscape of mergers and acquisitions (M&A). While financial, operational, and legal aspects dominate due diligence and negotiations, brand strategy directly shapes how key stakeholders—employees, customers, investors, and the market—perceive and respond to the transition pre-, during-, and post-merger.

PE firms should treat branding as a value creation lever from the earliest stages of the strategic plan.

“Our experience and interviews with leading M&A executives indicate that marketing (brand) plays a vital role in integration and deal success and should not be an afterthought.” – McKinsey

Where Branding Fits Within M&A Complexity

Pre-Merger: Strategic Planning & Due Diligence

In the early stages of any M&A transaction, it’s critical to conduct a brand equity assessment, evaluating the value, reputation, and perception of each brand involved. Are you dealing with a cash cow with strong brand equity or a problem child needing strategic attention? Understanding each brand’s positioning helps inform integration planning and long-term value delivery.

Cultural alignment is equally vital—ensuring brand values and corporate cultures are compatible helps avoid post-merger friction. Everyone needs to move in the same direction for a unified future.

A clear decision must also be made about future brand architecture: brand consolidation, a hybrid model, or a new brand identity. This decision should align with long-term business goals, customer expectations, and competitive positioning.

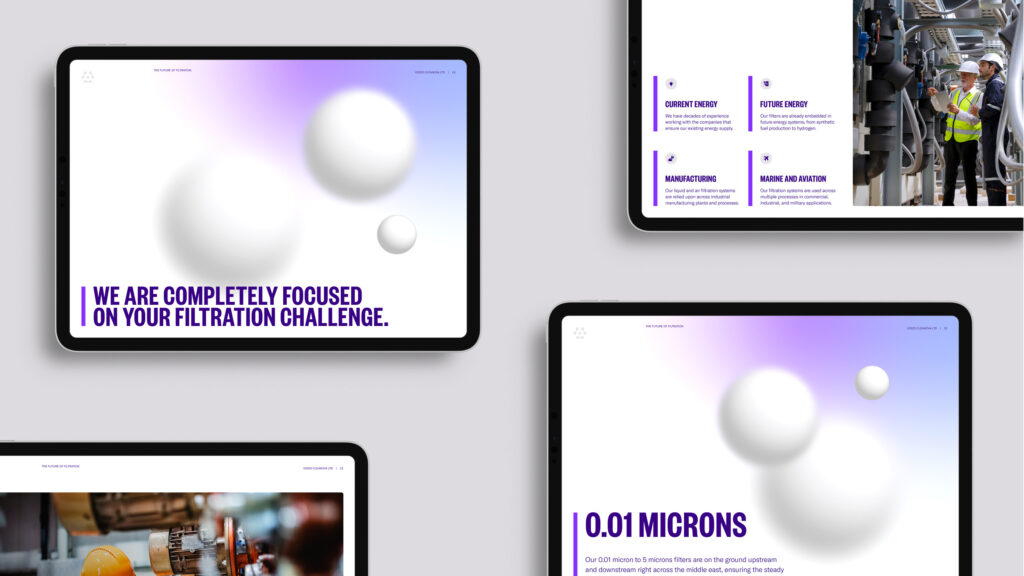

Case Study 1: Cleanova – Honouring Legacy, Innovating the Future

Cleanova was launched through PX3 Partners’ strategic carve-out of the filtration business from Celeros Flow Technologies, bringing together trusted names like Airpel, Vokes, Plenty Filtration, and Dollinger.

We built a new brand from scratch—from strategy and messaging to the creation of the name Cleanova—through a carefully crafted creative process. The challenge: differentiate in a trust-driven industrial market, while preserving the equity of four legacy brands. The outcome: a bold, innovative brand that signals both transformation and continuity.

Since launching its strategic branding program in October 2023, Cleanova has achieved strong growth through acquisitions and new contracts.

“Cleanova has the agility and enterprise of a new entrant combined with the experience and proven technology intrinsic to our brands.” – Javaid Riaz, CEO.

“We are excited about the possibilities ahead. Our commitment to excellence and customer satisfaction remains unwavering.”

During the Merger: Communication & Positioning

A merger is not just a financial or operational shift—it’s a human experience. Many employees ask, “What does this mean for me?” That’s why clear, consistent communication is vital. Early engagement builds trust and reduces uncertainty, creating a strong internal foundation.

Transparent internal communications signal brand stability and business continuity. Simultaneously, reassuring customers about service and product consistency maintains loyalty. This phase is also an opportunity to reshape perception and elevate brand positioning.

For investors and the market, a consistent, well-articulated message prevents brand dilution, eliminates confusion, and reinforces confidence in the company’s future.

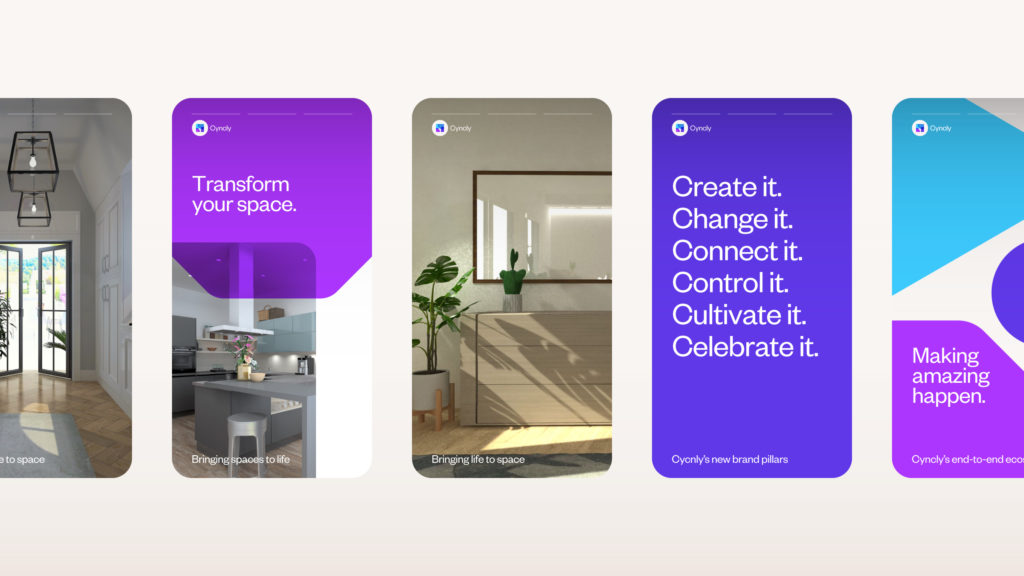

Case Study 2: Cyncly – Unifying Legacy to Drive Scale

Cyncly was formed through the merger of industry-leading software providers Compusoft Group and 2020, combining over 30 years of experience in design, visualisation, and manufacturing software to create a global SaaS leader. The merger marked the beginning of a strategic roll-up—bringing together best-in-class solutions to consolidate a fragmented market and create a unified global platform. Today, Cyncly operates as a powerful platform play, connecting every part of the design-to-manufacture journey.

We led the creation of a new B2B tech brand from the ground up—developing brand strategy, naming, visual identity, and a new website. The challenge: craft a unified global brand that honours legacy while signalling bold innovation. The result: a brand anchored by a powerful value proposition, ‘Make It Amazing’, and 'Cyncly'—a name inspired by ‘synchronisation’ and ‘simplicity’.

Since launching its new brand identity, Cyncly has continued to scale globally—now supporting a growing ecosystem of 70,000+ customers in over 100 countries, with an expanding portfolio of industry-specific solutions that empower designers, retailers, manufacturers, and consumers to work better together—and Make It Amazing.

“Our new brand, Cyncly, unites us and encompasses our passion to drive innovation to enable our customers to be more successful. Bringing together best-in-industry solutions from all our brands, Cyncly helps everyone in the value chain make their work and the outcomes for their customers amazing.” – Joerg Jung, CEO.

Post-Merger: Brand Integration & Execution

Branding isn’t a short trip, it’s a journey. Post merger the brand needs nurturing, success hinges on aligning visual identity, messaging, and culture across all touchpoints: logos, websites, internal systems, and marketing.

Internal rollout is key to employee engagement. Reinforcing shared values and corporate purpose drives alignment and cohesion.

Externally, a strategic brand relaunch ensures stakeholders—customers, partners, media—understand the change and continue their relationship with confidence. Done right, post-merger branding can drive growth, improve market positioning, and amplify competitive edge.

Key Branding Challenges in M&A

- Customer Retention Risks: Mishandled rebrands can alienate loyal customers and damage reputation.

- Cultural Clashes: Poor alignment between brand values and company cultures can undermine operations.

- Loss of Brand Equity: Ignoring the legacy value of acquired brands can weaken your overall brand strength.

Why Private Equity Firms Should Care

For PE firms involved in M&A, branding isn’t just a marketing checkbox—it’s a strategic lever for value creation. A well-executed brand strategy enhances enterprise value, supports customer retention, and improves exit multiples.

...

Want to learn more about value creation? Let’s discuss how strategic brand positioning can drive growth and enhance exit value. Contact us.

Published by: Fara Darvill in Thought leadership, News

Comments are closed.